Metformin is the most widely prescribed diabetes drug in the world. Many diabetics couldn’t take the drug because of adverse side effects or impaired kidney function. Metformin could accumulate in the plasma, resulting in lactic acidosis, a fatal adverse event.

Elcelyx Therapeutics is developing a delayed-release formulation of metformin (Met DR) which limits the absorption of metformin into the blood, avoiding the risk of lactic acidosis. The company just closed a $40 million Series E financing to advance the program.

The mechanism of action of metformin remains incompletely understood. A decade ago, scientists suggested that metformin reduces glucose synthesis via activation of AMPK[1]. Researchers from the University of Pennsylvania challenged the AMPK hypothesis and provided a novel mechanism by which metformin suppresses the glucagon signaling[2].

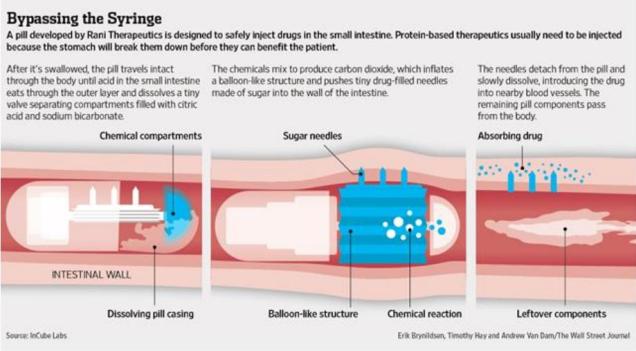

Elcelyx researchers have their own thoughts. They believe the gastrointestinal tract is the principal site of action of metformin[3]. The drug can enhance the secretion of GLP-1 in the intestines. Thus metformin is not necessary to be absorbed into the blood.

Currently existing formulations of metformin (Met IR/XR) dissolve in the stomach, where the drug is absorbed into the blood. In contrast, Elcelyx’s delayed-release formulation passes through the stomach, and release metformin in the intestines. The metformin concentrations in the plasma were reduced by 75%.

Elcelyx has completed a 12-week, 240-patient trial[4]. The mean 4 week FPG reductions were -13 mg/dl and -18 mg/dl for 600 mg and 1000 mg Met DR. As a non-blinded reference, Met XR 1000 mg and 2000 mg resulted in FPG reductions of -12 mg/dl and -25 mg/dl. In other words, 600 mg Met DR produced a reduction in FPG similar to 1000 mg Met XR, while 2000 mg Met XR resulted in additional reductions in FPG compared to 1000 mg Met DR.

Elcelyx intends to develop Met DR for patients with kidney impairment. The Phase III trials would cost $100 million or more, which means the company may need to raise more money. I am not so optimistic about the gut-based pharmacology of metformin. It was published in PLoS One that was filled with lower quality papers.

[1] J Clin Invest. 2001, 108(8), 1167-1174.

[2] Nature. 2013, 494(7436), 256-260.

[3] PLoS One. 2014, 9(7), e100778.

[4] Diabetes Care. 2015, pii: dc150488.